Fraud May be Foreign to Nigerian Businesses

Before you proceed you might want to know this; This blog post is different.

For this blog post, we needed to know the disposition of Nigerian businesses towards Fraud and by extension, fraud solutions. To do that, we needed two sides to the subject. The first side, Nigerian businesses and the other, Nigerians.

What Does Fraud Mean to the Average Nigerian?

When the average Nigerian hears “fraud”, they automatically think of internet scams – the type traditionally referred to as “Yahoo Yahoo”.

This is not surprising, and here’s why.

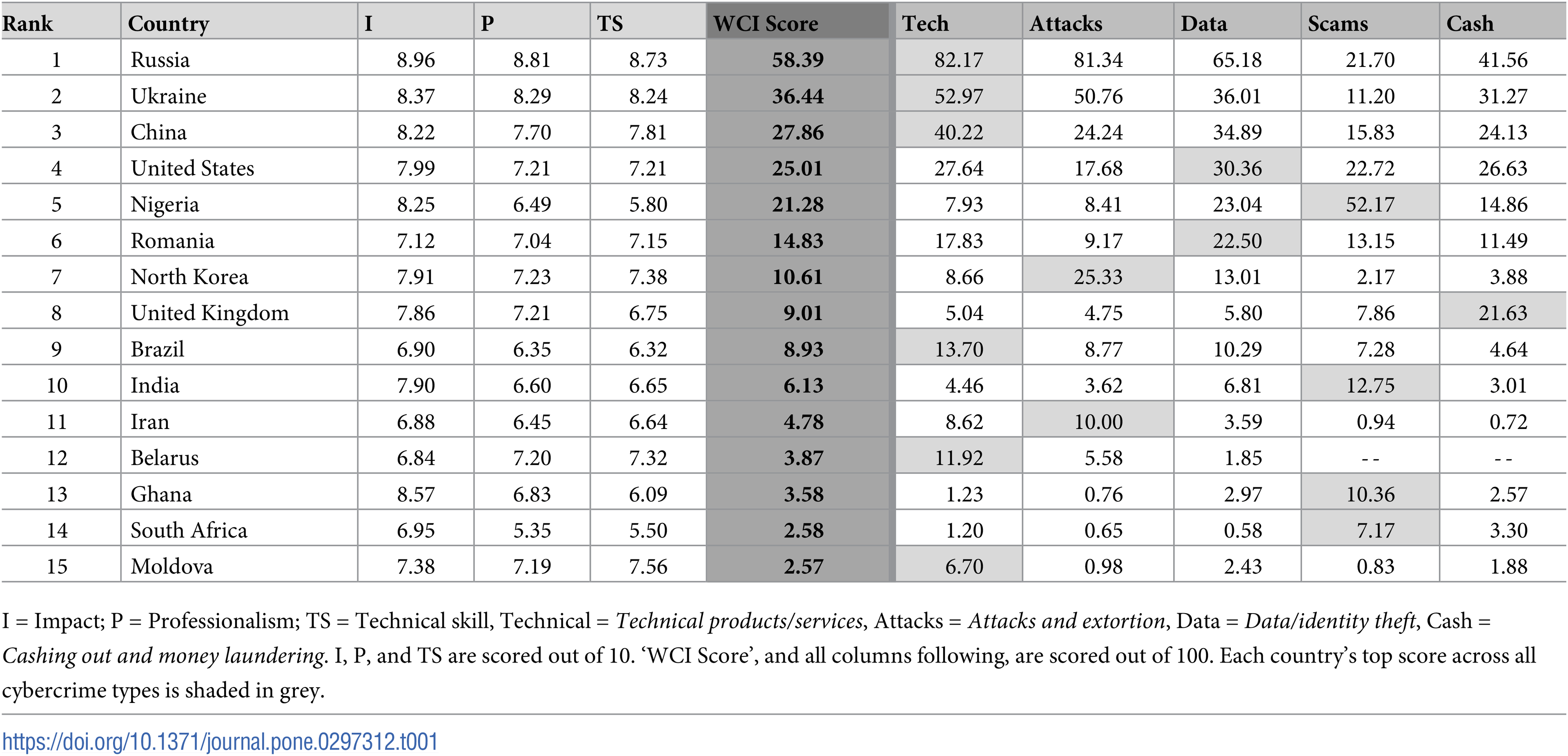

For this blog post, we had to comb through 10 credible sources for the current global cybercrime ranking. This included sources like Seon, Tech Business News, Analytics Insight, Sanction Scanner, Nairametrics, Yahoo Finance, and the World Cybercrime Index. Seven out of the ten sources ranked Nigeria within the top 5 countries with the highest internet scam risk. One of the reports, the world’s first world cybercrime index was based on 3 years of research gathered through a survey of 92 leading cybercrime experts from around the world, who are involved in cybercrime intelligence gathering and investigations.

Based on these ratings, cyber fraud is a very crucial topic for the Nigerian audience, as most individuals aged between 25 and 57 have fallen prey to an internet scam in Africa.

Our verdict? The average Nigerian is no stranger to cyber fraud – they are mostly victims.

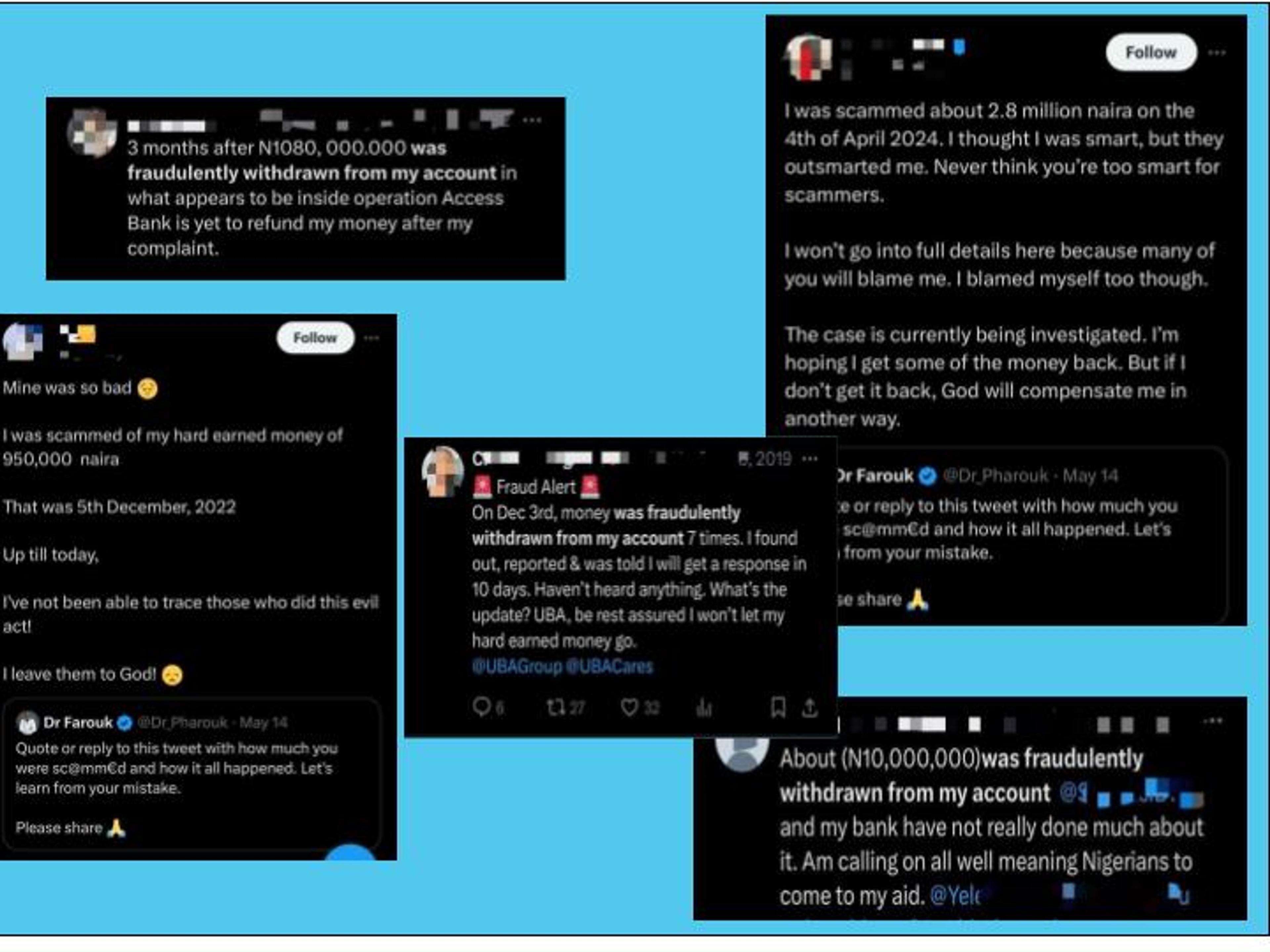

The internet is littered with cases of Nigerians who have fallen to several types of scams, including phishing attacks, impersonation scams, crypto scams, investment scams and advance fee fraud. These attacks add up to billions of naira lost to online scammers with victims suffering adverse effects ranging from hopelessness to depression, debt, and bankruptcy.

To the average Nigerian, fraud is both a clear reminder of the uncertainty of the safety of their funds as well as an indelible stain on the reputation of every citizen of the country. Most importantly, the mention of “fraud” is a caution sign to every Nigerian citizen with something to lose.

That “something” being, money.

What Does Fraud Mean to the Average Nigerian Business?

Every business needs funds to be sustained. As such, any threat to the inflow or outflow of funds in the business is taken seriously.

But that’s the thing, it has to be considered a threat first.

Here are some stats on fraud and the Nigerian Business landscape:

Those stats are convincing enough to get any business to beef up their security against fraud right?

Wrong!

The reason links back to what fraud means to the average Nigerian.

Let’s put it this way, most Nigerian businesses are run by Nigerians.

Nigerians perceive fraud as an entity that seeks to rob them of their financial assets.

Therefore, Nigerian businesses consider the threat of fraud from a customer perspective rather than from an organisational point of view. In other words, the threat of fraud is borne mostly by customers rather than businesses.

Here’s an illustration:

Mr X tries to acquire goods from Company B. Unfortunately, Mr X falls victim to an impersonation scam by a social media page posing as Company B.

Mr X loses money.

Company B loses “nothing”.

Here’s another example:

Mr A’s sports betting account gets hacked by online scammers and Mr A wakes up to find out that there’s been a fraudulent withdrawal of funds from his bank account via the sports betting platform.

Mr A loses money

Mr A complains to the Sports Betting platform

Sports Betting platform apologises for the inconvenience

Sports Betting Platform loses “nothing”

In both cases, while businesses were involved, customers ended up being the “sole victims”. Hence, the average Nigerian business sees no need to invest resources to actively defend against a threat that is not theirs to bear. At most, these businesses put up warning posts on their websites and social media pages to warn their customers against potential scams.

But here’s where Nigerian Businesses miss it?

THEY DO NOT LOSE NOTHING!!!

How Does Fraud Affect Nigerian Businesses?

Businesses lose 5% of their revenues to fraud each year!

That includes Nigerian Businesses, and whether or not they acknowledge the threat of fraud, the threat remains a crucial financial risk.

Here are some reasons why your Nigerian business needs to pay attention to fraud:

#1. Damaged Reputation

Notice how we kept putting “nothing” in inverted commas in the phrase “Company … loses nothing”? Well, that was intentional because those companies are definitely losing something.

What are they losing? Customers!

If a business is known for having had security breaches or fraud issues, it can damage its reputation and lead to lost customers. So, while the customer may look like the direct victim of the fraud, the companies have to suffer the loss of a customer and all the potential revenue attributable to the customer.

#2 Direct Financial Loss

Customers are not the only targets of fraud attacks. In fact, most high-profile scammers prefer to go after businesses. As such, businesses are as prone to financial loss due to fraud attacks as customers.

Fraudulent transactions can involve stolen money from the business itself. This could be through hacking attempts, malware attacks, fake checks, credit card scams, or even employees stealing from the company.

#3 Chargebacks

When a customer disputes a fraudulent charge on their credit card, the bank often reverses the transaction and takes the money back from the business. This leaves the business with the cost of whatever good or service was provided, but no payment.

#4 Cybersecurity Costs

Cyberfraud attacks take a financial huge toll on businesses. Even worse, the cost of recovering from a successful attack can also be great, including repairing damage to systems and regaining lost data.

Considering this, it is a more prudent decision to defend against these attacks than fall prey to them. As such, it is good financial advice to invest in security measures to prevent these expensive attacks.

In summary, while the concept of fraud may seem foreign to Nigerian businesses, considering the short-sighted perspective of attributing the risk of fraud to customers, the aftermath of fraud may affect businesses even more.

As such, fraud solutions should not just be considered but prioritized. Intelligent AI fraud detection solutions like Sigma have been proven to not just identify fraudulent transactions but also defend businesses against fraudulent attacks in the Nigerian business landscape.

Protect your business against fraud today.