How to Approach Cost-Sensitive Learning in Credit Scoring and Fraud Detection

Introduction

In the fast-evolving landscape of financial services, accurate decision-making is a paramount issue. The areas of credit scoring and fraud detection specifically demand precise, meticulous processes and tools to enable operators to differentiate between trustworthy and deceptive transactions.

Enter: cost-sensitive learning—a sophisticated approach to binary classification problems.

In this blog post, we'll discuss cost-sensitive learning in the context of credit scoring and fraud detection by navigating through the fundamentals of this approach. We'll explore its practical applications and delve into specific techniques, such as using cost matrices to achieve precision and reliability in the decision-making of financial transactions.

Understanding Cost-Sensitive Learning in Binary Classifiers

Cost-sensitive learning is a technique used in binary classifiers that is strategically designed to handle the challenges posed by imbalanced misclassification costs. Unlike cost insensitive classification algorithms, which are focused mainly with minimizing error rates, cost-sensitive learning takes a more sophisticated approach. Its primary objective is to minimize the total expected cost associated with misclassifications.

The technique recognizes that not all misclassifications carry the same weight. It acknowledges that in real-world applications, the consequences of false positives (erroneously flagging a non-fraudulent transaction as fraudulent) can be vastly different from false negatives (failing to detect a genuinely fraudulent transaction). Each misclassification carries its own distinct cost, which may vary widely between classes.

Cost-sensitive learning, therefore, assigns different misclassification costs to different classes, such as false positives vs false negatives. This strategic allocation of costs helps the classifier to make accurate predictions for the class with the higher costs. For instance, in critical areas like credit scoring and fraud detection, where the consequences of false negatives can be financially catastrophic, cost-sensitive learning enables the classifier to place heightened emphasis on accurately identifying such cases.

Our Approach: Cost Sensitive Learning in Fraud Detection and Credit Scoring

• Cost Sensitive Learning in Fraud Detection:

At Pastel, we employ cost-sensitive learning in our fraud detection processes to ensure we make the right decisions when identifying potentially fraudulent activities. One of the critical aspects of cost-sensitive learning is the ability to explicitly consider the costs associated with misclassification.

A key metric we use is the financial impact of misclassification of each class, often measured in terms of dollars. To represent these costs, we use a Cost Matrix that explicitly outlines the consequences associated with different types of misclassifications.

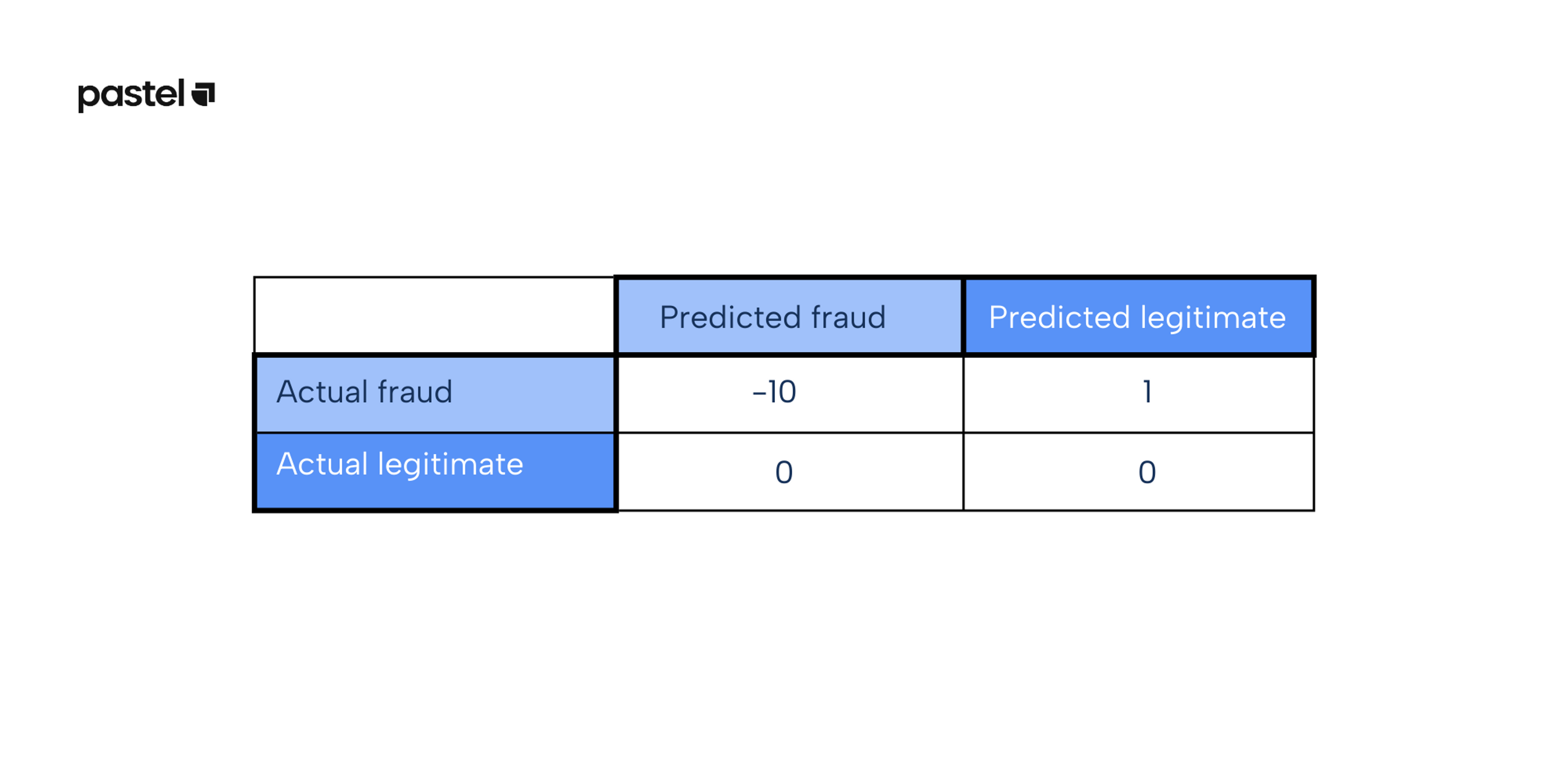

For example, in fraud detection, the cost of failing to detect a fraudulent transaction can be ten (10) times higher than the cost of incorrectly flagging a legitimate one. Therefore, the cost matrix for this scenario might appear as follows:

Cost Matrix for Fraud Detection:

• Cost-Sensitive Learning in Credit Scoring

Similarly, cost-sensitive learning plays a crucial role in our credit scoring practices, where the cost of misclassification can be imbalanced between different classes, such as approving credit to an unqualified applicant vs denying credit to a highly qualified one.

By assigning different misclassification costs for different classes, cost-sensitive learning can help to optimize the classifier's performance and reduce the overall cost of misclassification.

For instance, in credit scoring and approval, we may prefer to approve a credit request that later defaults, rather than deny a creditworthy applicant who would have made timely payments. Cost-sensitive learning can help identify these cases and make more informed decisions.

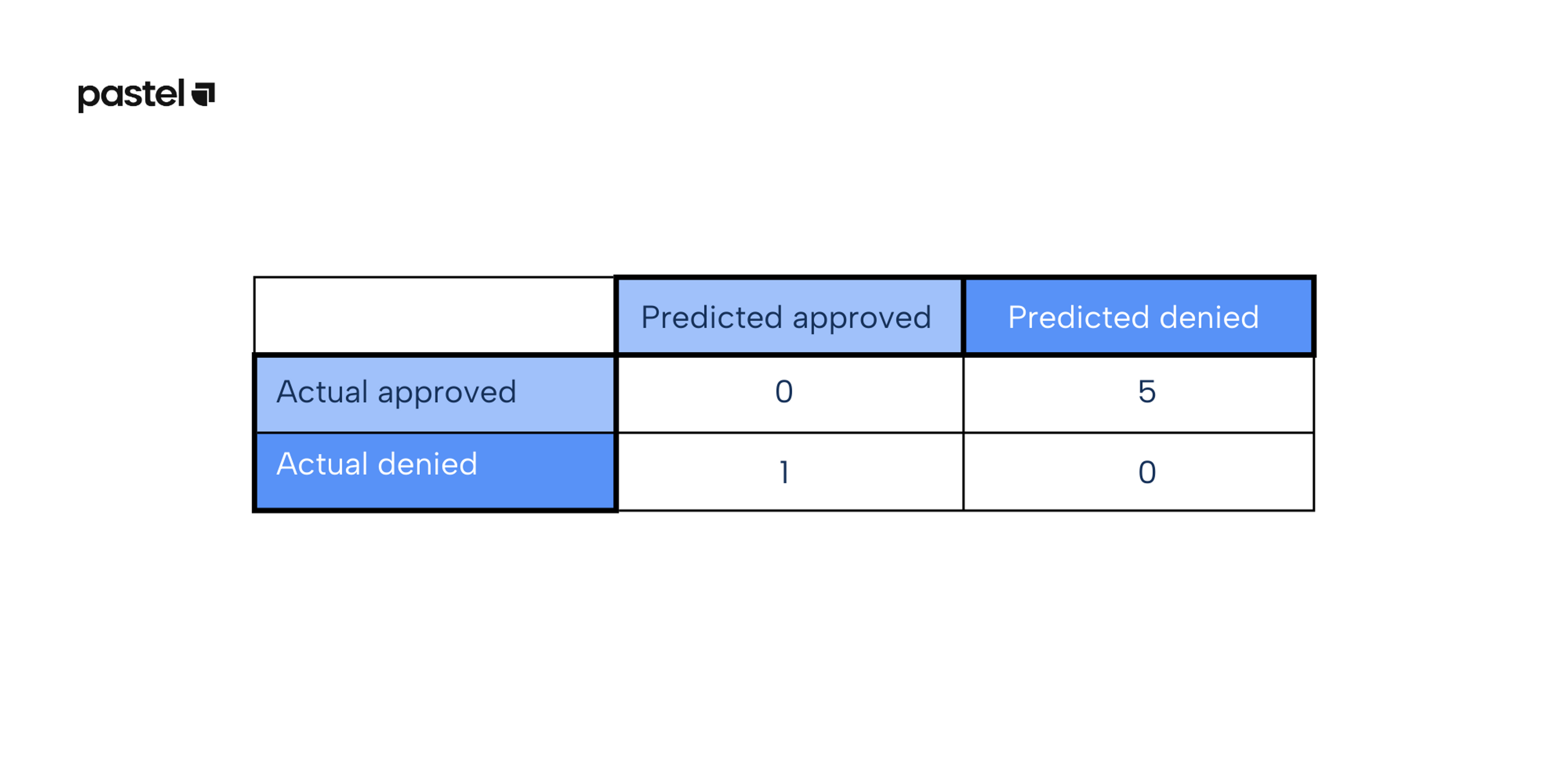

In credit scoring, the cost of denying credit to a qualified applicant could be five (5) times higher than the cost of approving credit to a non-qualified applicant. The cost matrix for this scenario might look like this:

Cost Matrix for Credit Scoring:

By leveraging cost-sensitive learning with these cost matrices, we can systematically consider the cost of misclassification. This approach allows us to optimize the performance of cost-sensitive classifiers.

Wrapping Up

Accuracy is crucial in the dynamic areas of credit scoring and fraud detection. Cost-sensitive learning is an essential technique for addressing the difficulties of imbalanced misclassification costs. Our commitment to implementing cost-sensitive learning in both areas underlines our dedication to accuracy and efficiency. Do book a demo session with us to learn more about how Sigma Transaction Monitoring and Credit Scoring solution could help meet your specific needs.